I believe that Splunk's dominant position in the Log Management market is a significant factor in its reputation for having the best overall Observability platform, despite not being as highly ranked in APM or Application Security. Splunk's Log Management solution has always been highly regarded and is widely used by organizations worldwide. Nevertheless, the company has successfully leveraged its customer and channel partner relationships and appears to be in a favorable position to lead the wider Observability market. It's worth noting that Splunk entered the broader Observability market only within the last 12-14 months and was arguably a late entrant.

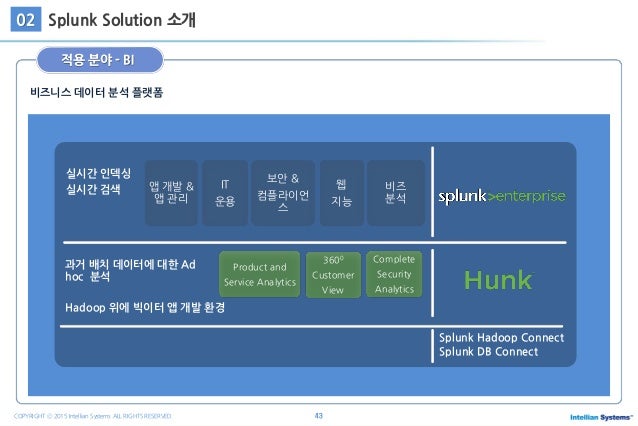

This, in turn, should enable the company to sustain long-term growth and profitability. In my view, Splunk has the most superior observability platform in the market and has established strong relationships with numerous large enterprise customers. Gartner Best Overall Observability Platform Additionally, Splunk was identified as a leader in the Cloud Observability market by GigaOM's Radar in 2022 and was recognized as one of the top players in The Forrester Wave for Security Analytics Platforms in 2020. Moreover, Splunk is ranked as a "Visionary" in Gartner's Magic Quadrant for the Application Performance Monitoring market. According to Gartner's Magic Quadrant Analysis for the SIEM market, Splunk was placed in the Leaders Quadrant in 2022. The management believes that they can seize a market opportunity worth $100 billion, comprising three key components: the Splunk Platform for search, analytics and data management, Splunk Security, and Splunk Observability. Splunk offers a Security and Observability platform with a wide range of capabilities.

#Splunk o11y free#

Overall, Splunk is managing well in a challenging macro environment, and the improved free cash flow profile is encouraging. The company plans to invest in the international market, seeing ample opportunities for growth. Splunk indicated that customers were delaying cloud migrations and expansions, consistent with recent quarters. The management on the call noted that 20% of the net-new ARR came from new customers. However, net-new ARR experienced a 43% decline compared to the previous year, while net-new cloud ARR declined by 46%. Annual Recurring Revenue grew 16% year-over-year, with cloud ARR growing by 29%, both slightly exceeding consensus expectations by less than 1%.

#Splunk o11y license#

This was likely supported by strong license revenue, which tends to have higher margins.

The operational leverage in the business model was a highlight, as the company achieved solid operating margin and free cash flow performance. Despite a challenging macro environment, the company demonstrated consistent execution. Splunk reported better-than-expected results for the quarter, surpassing guidance and consensus estimates. SPLK Investor Relations Q1 2024: Better Than Expected Quarter Across All Metrics Additionally, as revenue growth stabilizes, the company is likely to see operating margins expand due to higher cloud gross margins and new measures to cut costs. The company's revenue growth is becoming more consistent after a period of transformation, which remains a catalyst for growth. ( NASDAQ: SPLK) has made significant improvements to its platform, rewriting it to be cloud-native and strengthening its position in the Observability sector.

0 kommentar(er)

0 kommentar(er)